Public and Private partners are a key component of MobiVAT’s success. MobiVAT partners range from software publishers and developers to resellers, financial services providers, CPA experts and technology partners.

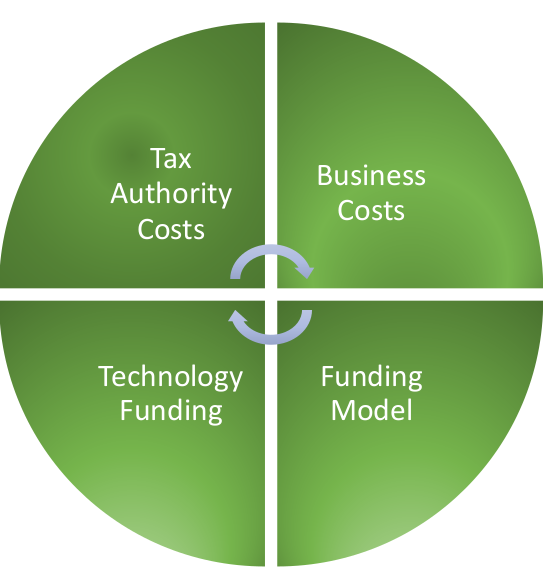

Inevitably there will be start-up costs to build the technology infrastructure and to re-position existing administrative infrastructure to handle the new systems

Public and Private

partners are a key

component of

MobiVAT’s success.

MobiVAT partners range

from software publishers

and developers to

resellers, financial

services providers, CPA

experts and technology

partners.

One good way is through

the partnership of the

public and private

sectors – working

together for mutual

growth and benefit.

These collaborations

enable goals, resources,

expertise and risk to be

shared and improve the

efficiency of developing

locally-adapted

innovation.

Banks and PSPs enable

merchants to accept

multiple payment

methods such as debit

cards, credit cards,

mobile money, mobile

wallets, and more.

The PSPs support these

different payment

methods with a single

simple integration.

In addition, merchants

are not required to set

up each individual

payment method.

MobiVAT works closely

with service delivery

partners to ensure

efficient and effective

delivery of our solutions

to our customers.

Integration with legacy

systems.

Redeployment of staff from

administration to fraud

protection.

Education of businesses to use

the new system.

Anticipated to be at most the

equivalent to the amounts

lost from few days of

continuing fraud.

The plan is to bring in a for-

profit group of companies that

will build out the whole

program and receive a small

percentage of what is

recovered due to the

implementation of the

MobiVAT system.

Some overhead in re-training

staff and accountancy costs in

switching to the new system,

The reduction in

administrative overheads and

reporting requirements

resulting from using the

MobiVAT system, should more

than compensate for short-

term losses.

There are a number of

possible financial models.

The important point is that

the entire system could be

financed from the recovery of

just a few days’ losses.

Savings to be recouped will

rapidly compensate for these

initial costs.

As VAT is a consumption tax the revenue generated will be constant.

Compared to other indirect tax VAT is easy to manage.

Due to catch-up effect of VAT, it minimizes avoidance.

As the VAT is collected in small installments so the consumers has minimum burden.

VAT is a neutral tax so it can be imposed on all types of business.

Huge amount of revenue is generated on a low tax rate through VAT.